Hearts and Arrows diamonds are a real sight to behold. In my Hearts and Arrows article I explain that a super-ideal cut Hearts and Arrows diamond does not sparkle more than a regular super-ideal cut diamond but it sparkles more rhythmically. When you look at one up close, the precision of the craftsmanship creates a sense of awe and it’s definitely worth it for those who can easily afford it. These diamonds don’t come cheap but if your budget allows it, owning one is a genuinely rewarding experience.

When it comes to where to buy a Hearts and Arrows diamond, two famous brands stand out: Whiteflash and Brian Gavin. Brian Gavin is a fifth generation diamond cutter and was one of the original founders of Whiteflash before launching his own brand. Whiteflash, founded in 2000 in Houston, Texas, was actually the first company to bring Hearts and Arrows diamonds from Japan to Western markets.

Here’s a direct comparison between the two top-performing Hearts and Arrows diamond lines: the A CUT ABOVE® from Whiteflash and the Black® by Brian Gavin from Brian Gavin Diamonds. Both feature identical specs (1.06 carats, E color, VS2 clarity), yet the Whiteflash diamond on the left is priced at $7,750 while the Brian Gavin counterpart lists for $8,777:

So which brand really has the edge in 2025? Is Brian Gavin’s higher price justified or does Whiteflash offer the smarter buy? Let’s find out as I take you through every factor that matters: from pricing and selection to craftsmanship, Hearts and Arrows precision, light performance and the overall buying experience. We’ll also take a close look at Brian Gavin’s patented cutting claims to see whether they translate into a real-world advantage.

For a short summary, see my Quick Verdict below. The full analysis continues right after for those who want the complete picture.

Quick Verdict: Which Should You Choose?

From my experience and detailed evaluation of both brands, Whiteflash comes out ahead. It delivers stronger overall value and consistency in the areas that matter most to buyers who care about true precision and transparency.

The following table highlights the key differences between Whiteflash and Brian Gavin in November 2025 that are worth considering before you make your choice:

| Feature | Whiteflash | Brian Gavin |

|---|---|---|

| Price | ✅ Consistently lower prices for identical specs within premium lines. | ❌ Higher pricing on comparable super-ideal diamonds. |

| Premium Inventory Size | ✅ 313 premium round diamonds (A CUT ABOVE® and Expert Selection) as of November 2025. Larger, fresher stock and better overall selection. | ❌ 212 premium round diamonds (Black® by Brian Gavin and Signature lines), smaller current inventory. |

| Browsing Experience | ✅ All diamonds visible with images and 360° views directly on the results page. | ❌ Requires clicking “View” for each diamond to see imagery, slower browsing experience. |

| Returns | ✅ 30-day return policy (10 days for non-branded or lab-grown diamonds). | ❌ 15-day return policy. |

| Lab-Grown Diamond Selection | ✅ 4,996 listed lab-grown round diamonds as of November 2025. Broader variety and easier filtering options. | ❌ 1,762 listed lab-grown round diamonds as of November 2025. Smaller selection and slower updates. |

| Imagery (Premium Lines) | ✅ Includes sparkle & brilliance 360° video, actual diamond photo, ASET, Hearts, and the extra IdealScope image for full light-performance transparency. ❌ Does not include the additional 70x magnified “fire” and “office” videos that Brian Gavin provides. | ✅ Offers sparkle & brilliance 360° video, actual photo, ASET and Hearts images, plus two extra 70x magnified videos (fire and office). ❌ Lacks IdealScope image for direct light leakage comparison. |

| Designer Collections | ✅ Partners with top global designers like Tacori, Verragio, Ritani and Simon G., giving access to the most recognized luxury engagement ring brands. | ✅ Focuses on in-house artistry and boutique collaborations (e.g., Fiorella®, Novela™, Sylvie, Parade), offering more personalized and creative collections. |

This updated comparison highlights the key areas where Whiteflash and Brian Gavin differ in 2025. Most other aspects of their offerings remain very similar in quality and reputation.

Why pricing matters more in 2025

With diamond prices stabilizing after several volatile years, even a small percentage difference can translate to hundreds of dollars in savings. Whiteflash continues to undercut Brian Gavin on comparable super-ideal cut Hearts and Arrows diamonds.

How premium inventory size affects your choice

A roughly 50% larger in-stock selection means greater flexibility, faster delivery and more chances to find your ideal specs. Whiteflash’s broader range helps you compare multiple options side-by-side with full transparency. That also applies to premium lab-grown diamonds where Whiteflash offers around 5,000 compared to about 1,700 at Brian Gavin.

Return policies and peace of mind

Whiteflash’s longer return window (30 days versus 15) offers more confidence for international buyers and anyone who wants time to review their diamond under different lighting conditions.

My Current Recommendation

Whiteflash offers more competitive pricing, a larger premium selection, a longer return policy on their branded diamonds and a smoother, more modern browsing experience. If I were starting my search for a Hearts and Arrows diamond today, I would begin with one of Whiteflash’s premium lines.

👉 Start with Whiteflash A CUT ABOVE®

The Price Difference Between Whiteflash and Brian Gavin Explained

Funny enough, the very next day after I first mentioned the 1.06 carat E VS2 Brian Gavin Black diamond at the beginning of this article, I saw that it was suddenly discounted. It turned out to be part of their “Shine Early” Black Friday Month event, offering up to 15% off natural diamonds:

At first, I assumed it was just a few select stones on sale as the banner suggested. But after checking all their listings, I realized the discount applied to ALL of their 212 premium round cut diamonds, including both the Black® by Brian Gavin and Brian Gavin Signature lines. In fact, all their diamonds were discounted between 10% and 15% and that same 1.06 carat diamond dropped by 12% from $8,777 to $7,723.76.

I mention that right here because I think that is the most important detail that you will ever need to know when it comes to comparing Brian Gavin and Whiteflash pricing. Whiteflash on the other hand NEVER discounts its natural diamonds. I know that and I confirmed it. You might occasionally see small promotions on ring settings or offers for lab-grown diamonds which is common across all major retailers since lab-grown prices fluctuate much faster. The only minor exception is a first-time customer incentive: when you create a new account, Whiteflash offers a $100 discount on purchases above $2,000. Beyond that, there are no seasonal or percentage-based sales. When it comes to natural A CUT ABOVE® or Expert Selection diamonds, the prices stay fixed year-round. And that consistency tells you something: their prices are already as low as they can responsibly go, with no need for seasonal markdowns.

So if one brand can afford to drop prices by 10-15 percent across every diamond and another never discounts at all, what does that really say about how those diamonds were priced in the first place?

Of course, now that the Brian Gavin Black diamond has been discounted to $7,723.76, we’re looking at a far fairer match against the $7,750 Whiteflash A CUT ABOVE®. Both diamonds share identical specs (1.06 ct, E color, VS2 clarity), so this is as close to a true side-by-side comparison as it gets. Whiteflash follows the textbook super-ideal cut formula with a 34.5° crown angle and 40.6° pavilion angle, optimized for balanced brightness and fire. The Brian Gavin diamond with a 40.8° pavilion angle gives slightly stronger contrast flashes, meaning the sparkle may look a bit punchier but the diamond may also appear just a touch less bright overall. If you want to understand exactly why those crown and pavilion angles matter, take a look at my complete diamond proportions guide.

When you look at the AGS Ideal® Report computer generated ASET images, the differences between the two become easier to appreciate. In the Black® by Brian Gavin diamond, the blue contrast zones appear not only thicker but also more concentrated around the center, giving it a stronger, high-contrast look. This aligns with its 40.8° pavilion angle, which emphasizes darker areas that make each flash of light stand out more sharply. The red brightness areas are still very strong, but the distribution isn’t perfectly uniform.

The Whiteflash A CUT ABOVE® diamond shows a more balanced and even spread of red brightness across the entire face, with consistent symmetry and just the right amount of blue for natural contrast. This creates a smoother, more fluid sparkle pattern that looks evenly bright from every angle. In short, the Black® by Brian Gavin diamond delivers bolder flashes and a punchier look, while the Whiteflash diamond maintains slightly higher brightness and overall harmony.

One small differentiator is fluorescence: the Brian Gavin diamond has medium blue, whereas the Whiteflash diamond has none. In an E-color diamond, medium blue fluorescence doesn’t create any haziness, but it can slightly reduce resale value simply due to buyer perception rather than performance.

Now, with the 12% discount applied, the price difference between the two has essentially vanished, making this a genuinely fair match. Most buyers would still lean toward the Whiteflash A CUT ABOVE® for its perfectly balanced light return, tighter proportions and no fluorescence, but the Black® by Brian Gavin diamond becomes a reasonable option at this discounted rate. The key takeaway is that at regular pricing, Brian Gavin’s diamonds appear to run roughly 10-15% higher than equivalent Whiteflash diamonds, which is a consistent pattern across their premium lines.

Understanding Brian Gavin’s Black Patent and Light Performance Claims

Of course, we haven’t yet talked about one of Brian Gavin’s biggest claims to fame: the patent behind his Black line and what it promises to do for diamond light performance. You can check out the official patent here. I read through the entire document and I’ll tell you what it really does for Brian Gavin.

The patent’s main function isn’t so much to define a revolutionary new cutting technique as it is to prevent competitors from claiming that they’ve discovered a mathematical formula that reduces green reflections in ASET images. It’s a way to legally “brand” his proprietary formula and of course, having a U.S. patent makes the claim look scientific and exclusive, even though the practical impact is very limited.

The patent specifically refers to AGS Ideal® Report computer-generated images, not to physical ASET images. In other words, the entire concept exists in simulated light-trace models, not in real-world photography.

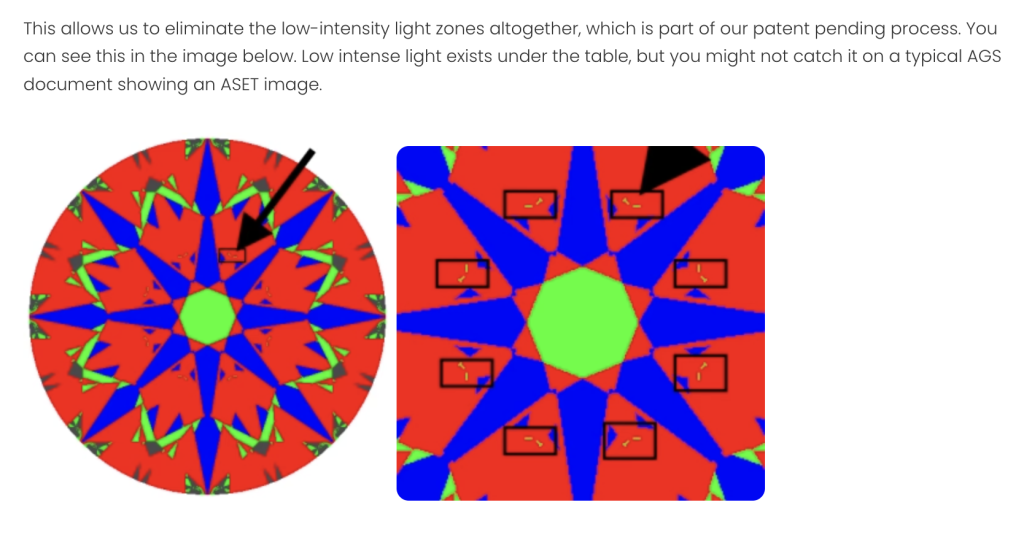

So what’s the patent actually about? The idea is to reduce the appearance of green light in the peripheral zones of the table facet, referring to areas that the AGS light-performance map labels as “Less Bright.”

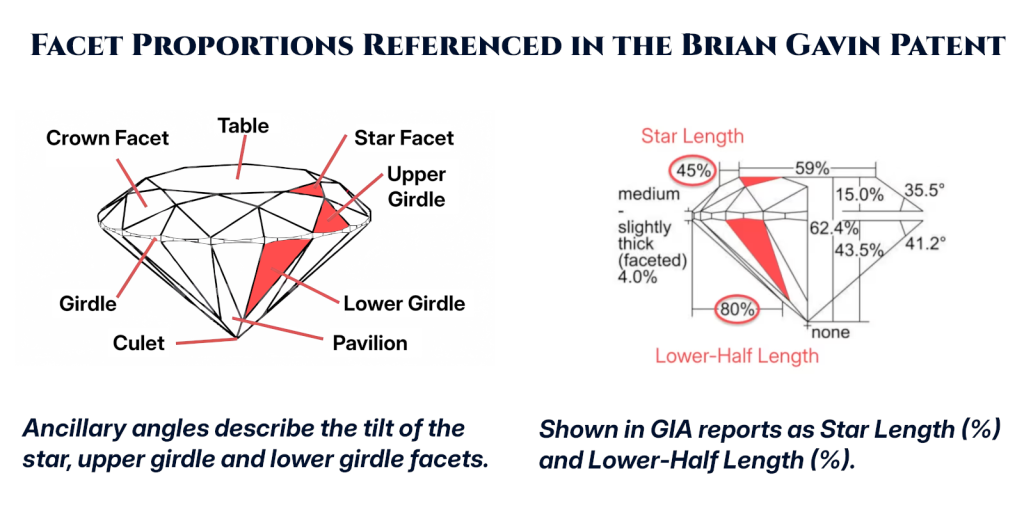

To achieve this, the patent describes making minute adjustments to what it calls the ancillary angles: the lower halves (lower girdle), upper halves (upper girdle) and star facets. In practical terms, that involves fine-tuning the familiar star length and lower-half length, along with other subtle proportions and angles that don’t appear on a standard grading report. Together they influence how light returns under the table.

Rather than offering one fixed formula, the patent defines a series of proportion ranges and mathematical relationships that connect the star, crown and lower-half geometry. It lists multiple tables of preferred and operable ranges for angles, lengths and even permissible azimuthal shifts when indexing is applied. Together, these define how small changes in lower-half length or angle say, from about 77 % and 42 °, can influence brightness in the peripheral zones under the table. In practice, shortening the lower halves slightly or reducing the angle by about 0.1 ° can help minimize faint green reflections near the table’s edge. The general zones where these adjustments occur are shown below:

Please note that Brian Gavin’s patent specifically addresses the green light in the peripheral zones of the table, not the center. The small dot in the middle of an ASET image can legitimately appear either red or green even in a world-class diamond. Above we can actually see two examples of that. The general rule is as follows: If the pavilion angle is below 40.768°, the center of your diamond’s ASET image will show up green, otherwise it appears red. This change doesn’t indicate a flaw, it simply reflects how light enters and exits the diamond. And as you might remember, the pavilion angle range for a true super-ideal cut lies roughly between 40.6° and 40.9°, which means this green-to-red shift happens almost right in the middle of the ideal range. (If you want to dive deeper into ASET images themselves, you can read my ASET guide.)

In short, the patent is about achieving a cleaner red ASET map by adjusting the micro-angles that surround the pavilion mains. That’s a perfectly valid goal, less green usually means stronger brightness. It’s just that you don’t need a patent to do that. Any skilled cutter using AGS-based modeling software could achieve the same result.

To put it in perspective, in the previous section we just compared AGS ASET images of a Whiteflash A CUT ABOVE® and a Black® by Brian Gavin diamond. I simply picked the first pair of diamonds I could find with identical 4Cs from their flagship collections. Both were super-ideal cut Hearts and Arrows diamonds. The Whiteflash ASET image already showed no green at all in those peripheral areas under the table, which proves that you don’t need a “Black-patented” formula to achieve a flawless light return.

Brian Gavin is now promoted as a fifth-generation diamond cutter, which already sounds impressive from a marketing standpoint. Add a patented formula on top and it’s easy to see how the brand story sells itself. In reality, any top-tier diamond cutter aims to minimize the green reflections in those peripheral table areas and they do it without a patent. As we’ve already seen, Brian Gavin’s diamonds are priced about 10-15% higher than Whiteflash’s. The patent simply provides a convenient justification for that markup. It’s a clever piece of marketing, but it doesn’t make the diamonds perform better. What it really does is give you a reason to pay more.

Inventory Depth and Image Quality

As shown in my introductory table, Whiteflash currently has a broader offering with about 313 natural premium round diamonds, while Brian Gavin lists around 212. What immediately caught my eye was how many of Brian Gavin’s diamonds date back to 2022 or 2021. You can notice that yourself because AGS Ideal® Reports from 2022 and earlier looked different. In Brian Gavin’s case, those older reports actually featured two AGS ASET images: one showing the arrows (face-up) view and another showing the hearts view.

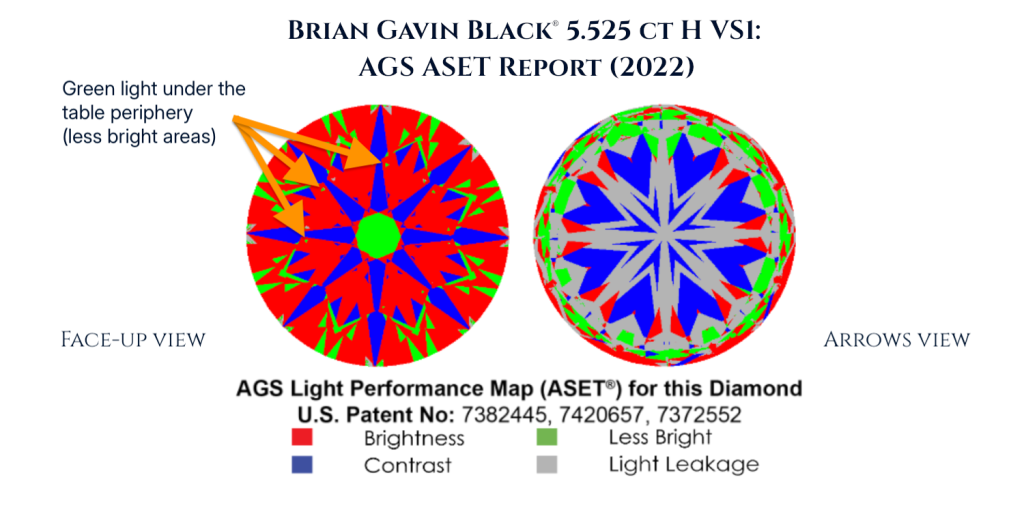

Currently, the most expensive Black® by Brian Gavin diamond available is a 5.525 ct H VS1 listed for $181,500. It dates back to 2022 and it comes with that older AGS Ideal® Report that shows both ASET views. When I looked at them closely, I could clearly see faint green light zones under the table’s peripheral areas, especially near the top section:

If you think I’m being pedantic by pointing out those faint green zones under the table’s edge, Brian Gavin himself takes this matter extremely seriously. On Brian Gavin’s official page explaining their patented cutting process, he highlights that the patented ancillary angles will eliminate even the smallest traces of green light around the table periphery. In fact, they go so far as to suggest that some green light may be so minimal that it doesn’t even show up clearly in an AGS ASET report but they will still eliminate it thanks to their patented angles. The excerpt below is taken directly from their site and it shows how extremely precise their focus on removing these faint light zones really is:

That means even the highest-priced Black® by Brian Gavin diamond on the site doesn’t fully achieve what the brand’s own patent set out to do, which is to eliminate all green light under the table periphery. I only noticed this when reviewing those older dual-ASET reports, but it’s revealing. By their own definition, that diamond shouldn’t technically qualify as a Black® by Brian Gavin diamond!

Whiteflash, unlike any other retailer, had a special partnership with AGS Laboratories that allowed them to offer the AGS Platinum Report, a version of the grading report that included three distinct ASET images. Brian Gavin, while long associated with AGS-graded diamonds, never had this same level of collaboration. These Platinum Reports displayed an ASET at 30°, another at 40° and a third hearts-view ASET, a combination that provided a remarkably complete picture of how a diamond handles light. If you’d like to see one of these older reports in action, take a look at this example of a triple ASET AGS Platinum Report, which includes both the tilted and hearts-view perspectives and most importantly: no green color under the table periphery!

As of 2025 however, the current AGS Ideal® Reports now come with just one ASET image. That’s because GIA acquired AGS in 2022, and AGS stopped issuing their traditional grading reports and they now only provide the AGS Ideal® Report with one single ASET image. From what I can tell, they’re working on something much bigger behind the scenes, likely tied to the AGS imaging technology that GIA wanted in the first place. Many diamond enthusiasts, myself included, hope that this multi-angle imaging approach will eventually make a comeback under GIA’s new AGS-based platform. If that happens, I’d expect Whiteflash to once again lead the way in light-performance imaging.

So when you compare inventory freshness, you can definitely notice the lower turnover rate with Brian Gavin. Nearly all Whiteflash reports are from 2024 or 2025, while many of Brian Gavin’s are several years older. Older diamonds don’t get worse with time, but newer reports do tell you something about stock rotation and sales activity. More choice and faster turnover are generally preferable because it signals an active inventory and higher buying volume, which often leads to better variety for the customer.

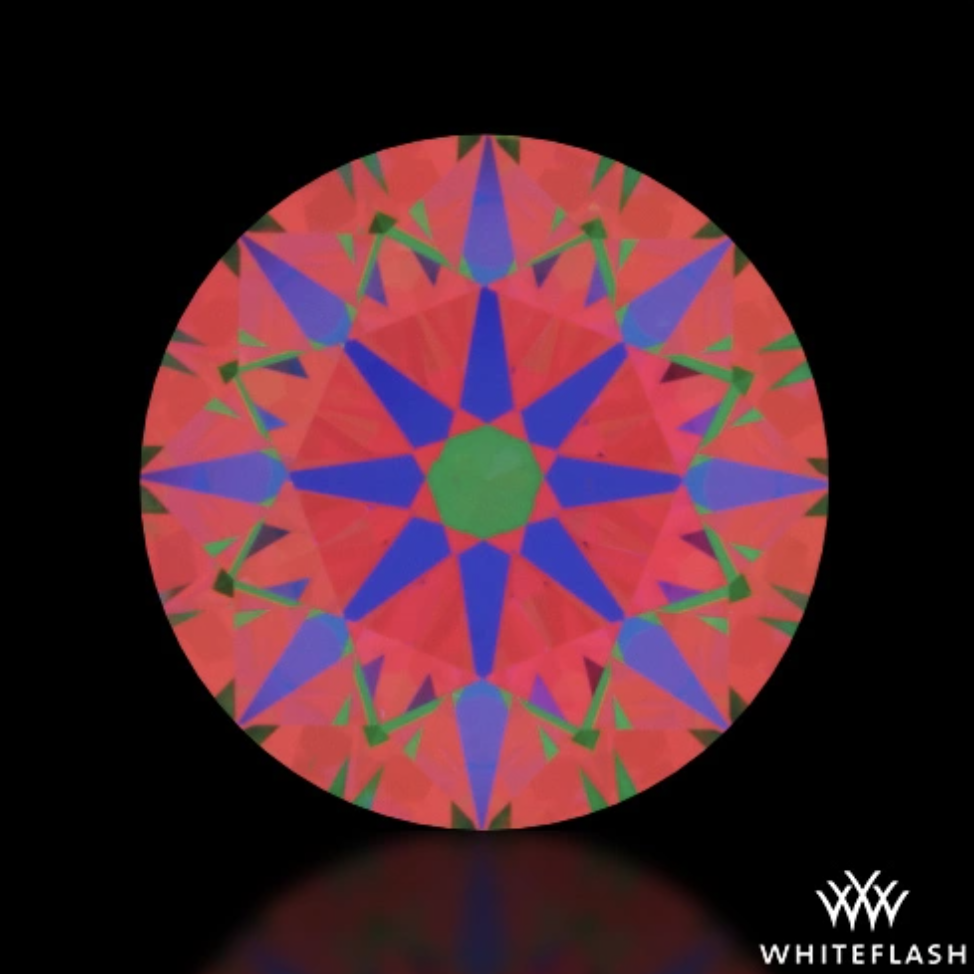

We’ve talked a lot about the AGS Ideal® Report, which now only shows one ASET image in its computer-generated form. But we haven’t looked at the real ASET images yet. These real photos are more informative because they reveal small variations in contrast, symmetry and minor alignment differences that the computer-generated version can smooth out. Both versions are valuable and serve their purpose, but the real ASET image gives you a closer look at the diamond’s true optical behavior under actual lighting conditions. Now that we’re back to our two original diamonds, let’s look at their natural ASET images:

Both are world-class performers and show exceptional light return, but you can still spot a few minor differences. In the Whiteflash image, the red field under the table looks slightly smoother with less green along the table’s periphery, especially near the 10 to 12 o’clock positions. The Brian Gavin image, on the other hand, shows faint green patches around the 11 and 1 o’clock areas and a touch more green in the upper girdle zones. These are tiny differences, but they highlight how sensitive ASET readings are to facet proportions and imaging conditions. It’s also worth remembering that both brands use slightly different ASET imaging systems. For a fair comparison, you should ideally compare two Whiteflash ASET images or two Brian Gavin ASET images. Comparing across systems will always carry some uncertainty.

People sometimes ask me which ASET technology is better or claim that one brand’s setup gives more accurate results. The truth is that both systems are equally capable of capturing the same light performance. The difference lies mostly in presentation: Whiteflash’s black background gives sharper color contrast and a more three-dimensional look, while Brian Gavin’s white background follows the more neutral AGS simulation style. The underlying data are identical. In my opinion, the Whiteflash version is simply easier to interpret visually, while the Brian Gavin version stays closer to the laboratory model. Both are excellent, just optimized for slightly different audiences.

After looking at ASET images, the next tool worth mentioning is the hearts image. While ASET images show how light enters and exits a diamond, hearts images reveal how precisely the facets are aligned. Both of these hearts images confirm the precision optical symmetry expected from super-ideal cuts. The difference lies entirely in presentation style, not diamond quality.

Whiteflash uses a red hearts-and-arrows viewer with a black background, giving the image a more jewelry-like appearance with soft reflections. Brian Gavin’s setup uses a blue filter and white background, which produce a sharper, more technical look that highlights the heart outlines more distinctly. Both diamonds display perfectly formed, evenly spaced hearts. For a deeper look at how hearts-and-arrows patterns are formed and what they reveal about diamond precision, you can read my Hearts and Arrows diamond guide.

So both Whiteflash and Brian Gavin use slightly different imaging styles across their ASET and hearts images, but the underlying quality is equally high. The same goes for their sparkle and brilliance videos that I showed right at the beginning. Different presentation style, same top-tier optical precision.

However, Brian Gavin adds something unique: a 70x magnification video that lets you view the diamond with extraordinary detail, even showing how it performs under different lighting environments such as office light and direct fire light. You can literally see the facet junctions and tiny inclusions that would otherwise be invisible to the naked eye. To my knowledge, 70x magnification is the highest level of zoom currently offered by any major online diamond retailer and it’s genuinely impressive for clarity inspection.

The 70x magnification video also moves differently than the regular brilliance or sparkle videos. Instead of simply rotating in a perfect circle, the diamond performs a subtle rocking motion. It tilts slightly back and forth as if you were holding it between your fingers and moving it under a light. This movement has a real purpose: it shows how the diamond reacts to shifting light in everyday conditions. When a diamond rocks like this, you can see how each facet lights up, fades and then reignites as the angles change. It reveals the true fire and scintillation pattern, the flashes of color and brightness that make a diamond look alive in real life:

In a standard 360° spin video, the lighting stays fixed relative to the diamond, so you mainly see symmetry, polish and overall brightness. The rocking motion adds an entirely different perspective. It lets you evaluate how well the stone handles dynamic light, how cleanly the facet junctions separate and whether the sparkle pattern is balanced or uneven. When the facet junctions separate cleanly, it means each facet turns on and off distinctly as the light moves. In other words, it’s the closest thing to turning the diamond in your own hand and seeing it perform from different viewing angles. It’s a very nice touch on Brian Gavin’s part.

That said, Whiteflash balances this advantage with another powerful feature: the inclusion of an additional Ideal Scope image. This red-and-white reflector image focuses solely on light leakage and contrast and it gives you a quick, intuitive way to spot areas where light may be escaping the diamond. While the ASET image already provides a broader, more detailed view of light performance, the Ideal Scope simplifies that data into a visual that’s easy to interpret at a glance. In cases where a diamond already includes both a real ASET image and an AGS-rendered ASET simulation, the Ideal Scope becomes a nice extra, but it doesn’t reveal any information beyond what’s already shown in the ASET results. For a detailed explanation of how to read Ideal Scope images and what to look for in light leakage, see my Ideal Scope guide.

So in this area, Brian Gavin wins in magnification and lighting variation, while Whiteflash wins in imaging completeness. Both brands give buyers exceptional transparency, but each leans toward a slightly different strength.

Key Policy Differences Between Whiteflash and Brian Gavin

When it comes to service policies and customer assurances, Whiteflash and Brian Gavin Diamonds are remarkably close in overall integrity but diverge in a few key details, which I have listed below:

| Feature | Whiteflash | Brian Gavin |

|---|---|---|

| Return Period | ✅ 30-day returns for in-house natural and catalog items (10 days for lab-grown or non-catalog). | ❌ 15-day inspection period for all diamonds and jewelry. |

| Lifetime Upgrades (Natural Diamonds) | ✅ Lifetime Trade-Up on all A CUT ABOVE® diamonds with 50% higher purchase requirement. | ✅ Lifetime Upgrade on all Signature lines (including Black, Signature rounds, Signature princess etc.). Same 50% rule applies. |

| Ring Box & Packaging | ✅ Elegant, traditional presentation with a glossy solid wood jewelry box, soft cream interior and gold ribbon accent. Designed to maximize the emotional “reveal” moment with a timeless, luxurious feel. | ✅ Modern and minimalistic packaging featuring a soft-touch magnetic box, gem-cut ring box and custom die-cut foam interior. More technical than decorative. |

| Lab-Grown Diamond Upgrades | ❌ No published upgrade path for lab-grown diamonds. | ✅ Trade-in possible for BG Premium Lab to another Premium Lab or to a Signature Natural diamond, value adjusted to current market. |

| Buy-Back Policy | ❌ No buy-back policy. | ✅ One-year buy-back for Signature diamonds at 70% of current market value. |

| Eye-Clean Definition | ✅ Inclusions not visible face-up from 10 inches under normal overhead light (20/20 vision). | ✅ Inclusions not visible face-up from 8-10 inches in natural daylight (20/20 vision). |

| Shipping & Insurance | ✅ Free insured FedEx shipping (Hold for Pickup standard) worldwide. | ✅ Complimentary FedEx Overnight (orders $5,000+), 2-Day for $1,000-$4,999. ❌ Shipping fee under $999. |

| Payment & Financing | ✅ Accepts cards, PayPal, Apple Pay, bank wire (3% discount). Also offers Affirm financing and a 90-day Flex Plan (layaway). | ✅ Accepts cards, PayPal, Zelle, wire (3% discount on Signature; 1% on Virtual). Offers Affirm financing. |

| Outside Diamonds | ❌ Generally does not set or work on diamonds not purchased from Whiteflash (rare exceptions). | ✅ Will set customer-owned diamonds into catalog or custom settings (fees apply). |

| Service & Resizing | ✅ One free resize within the first year (±1 size). Customer pays shipping. | ✅ One free resize (±1 size). Customer pays shipping. Beads extra. |

| Custom Work | ❌ Custom or altered pieces are final sale. | ❌ Custom, handmade, bezel and many designer settings are all final sale. |

| Social Responsibility | ✅ ISO 9001 certified, UN Global Compact member, conflict-free sourcing, charity involvement, BBB Pinnacle Award. | ✅ Conflict-free sourcing stated. ❌ No ISO or third-party CSR certifications listed. |

So Whiteflash provides the longer inspection period (30 days vs 15) and an ISO-certified quality-control system, which underscores its structured, enterprise-grade approach. Its focus on A CUT ABOVE natural diamonds keeps its lifetime upgrade program narrower but extremely consistent. Brian Gavin Diamonds meanwhile, opens its lifetime upgrade to a broader range of branded stones and even backs it with a one-year buy-back at 70 percent of market value, a rare consumer safeguard.

Whiteflash wins on free global shipping, longer returns and extra perks like the tool kit and ISO credential. Brian Gavin edges ahead on buy-back flexibility, lab-grown upgrade options, and the impressive 70x magnification fire view that adds a microscopic inspection level no other retailer currently offers.

In short, Whiteflash feels like the polished corporate benchmark, Brian Gavin feels like the craftsman’s studio, each outstanding in its own way.

Final Verdict

Both Whiteflash and Brian Gavin offer world-class craftsmanship, so you can’t really go wrong with either. But when you look closer, the numbers speak for themselves. Brian Gavin’s diamonds are generally 10-15% more expensive than equivalent Whiteflash A CUT ABOVE® stones and that’s the single biggest drawback. The big sales across Brian Gavin’s premium lines can make you feel like you have to wait for the next big discount just to get a fair price.

Whiteflash, on the other hand, never discounts natural diamonds and that policy actually works in your favor. It means transparent pricing year-round and the confidence that you’re getting a consistent, market-based value every time you shop. Add in their larger in-stock selection and a smoother browsing experience, and Whiteflash simply feels like the safer and more practical choice overall.

If you’re serious about buying a top-cut diamond without the guesswork, Whiteflash is where the odds and the sparkle are in your favor. No need to wait for a sale or scramble for a coupon.